10 Best Risk Management Tools

Here's my pick of the 10 best software from the 22 tools reviewed.

Get free help from our project management software advisors to find your match.

There are so many different risk management software so making a shortlist of the best can be tricky. You want to analyze risks, track them over time, and plan strategies to manage them effectively - and need the right tool. I've got you covered! In this post I share from my personal experience assessing and managing risk for multiple companies, using many different risk management platforms, and share my picks of the best risk management software.

What Is Risk Management Software?

Risk management software is a tool that helps businesses identify, assess, and manage potential risks. It's designed to track and analyze various risk factors that could impact a company's operations, finances, or reputation.

This software is useful for planning and decision-making. It provides insights to minimize potential losses, ensure compliance with regulations, and improve overall business resilience. By using risk management software, companies can better prepare for uncertainties and protect their interests.

Overviews Of The Best Risk Management Software

Here’s a brief description of each of the best risk management systems that are featured on this top 10 list.

Best GRC tool for real-time risk assessments and risk mitigation

Alyne is a full-suite GRC platform for governance, risk, compliance, and ESG that was created to give dynamic enterprises of all sizes data-driven insights powered by AI technology.

The platform assists teams in enhancing transparency and compliance effectiveness, intuitively identifying hazards in real time, and working more productively with both internal and external stakeholders. Use automated risk identification and qualification, ready-to-use templates for controls and assessments, and relevant methods for risk quantification to save costs and accelerate time to value. It's tailored for businesses that need a comprehensive approach to risk and compliance. By focusing on the unique challenges of enterprises, Alyne provides tools that directly address and alleviate these concerns.

With Alyne, you can easily track and manage your compliance with various regulations and standards. It's got this great dashboard that gives you a real-time view of your compliance status, making it easy to spot any potential issues and address them before they become a problem. Notable among these are its detailed risk assessments that delve deep into potential pitfalls, as well as its compliance mapping that provides clarity on regulatory landscapes. It also offers actionable reports, which can be a boon for decision-makers.

Alyne's integrations include key enterprise platforms such as SAP, Salesforce, and Oracle, ensuring that data flows are coherent and uninterrupted.

Pricing is available upon request.

New Relic is a complete performance monitoring and management platform. You can use it to get an all-in-one overview of your applications, infrastructure, and customer experience. The vulnerability management module is well-suited to risk and security management use cases.

The software integrates with over 500 other tools, meaning you can centralize your data in it for effective, comprehensive security management. With this data, you can identify vulnerabilities and bridge the gap between security and development. The platform's AI assistant 'Grok' can read your telemetry and identify outliers for you. You can also ask it questions, and it will find a root cause for an issue and provide you with potential code changes.

New Relic integrates with over 500 apps including AWS, Google Cloud, Microsoft Azure, Jenkins, CircleCI, Travis CI, and Slack. It also has an API you can use to build custom integrations.

New Relic costs from $49/user/month and has a free version available with feature limitations.

StandardFusion is an end-to-end Risk Management platform built to deliver the visibility, centralization, and collaboration that organizations need to mitigate information security risk and enable information security teams to drive revenue growth.

The platform is made up of six core solutions (Risk, Compliance, Audit, Vendor, Policy, and Incident), each built to be highly configurable with centralized data so that users have visibility across all their risk and compliance programs at any stage, and at any moment, produce an evidencable report to satisfy audits and stakeholders.

The old stigma of Risk Management, Compliance, and Information Security teams hindering growth, slowing productivity, impeding creativity, and generally getting in the way of everyone doing their job is gone. StandardFusion is empowering Information Security teams more than ever to proactively manage risk, grow revenue, speed up productivity, and gain new business.

In terms of compliance features, StandardFusion natively supports most standards straight out of the box including: IPAA, FEDRAMP, NIST, ISO, PCIDSS, SOC 2, GDPR, and CCPA. You can start by using StandardFusion as is, and then you can tailor its parameters to your organization's needs.

The risk management features help you assess and track individual risks, mitigating actions, and their outcomes which can be quickly summarized using the report generator. Users can assess and estimate the likelihood and impact of a potential risk using one of the many included qualitative and quantitative risk methodologies or, as I mentioned earlier, users can define their own parameters for risk assessments. Additionally, users can drag and drop files to upload, automate recurring processes, perform risk assessments, create reports at the press of a button, track and monitor risks, establish mitigating controls and customize user-level parameters all within one central platform.

Something I love about StandardFusion is their simplistic and powerful interface. Mostly, navigation is straightforward and you can get anywhere you need in just a few clicks. Even users with limited knowledge of the software will get on well, thanks to an intuitive layout.

On top of that, they offer in-depth product training sessions and user guides. Technical support, in-person training, and dedicated success managers are all accessible as well.

A final standout aspect of this tool is the transparent pricing structure, which can be tough to find in an enterprise-grade tool. Pricing terms are laid out upfront with no surprises. And all plans grant users access to the full functionality of the platform, with additional included features and integrations as the plans scale.

StandardFusion has multiple existing integrations including; Jira, Confluence, Slack, OpenID, DUO, and Google Authenticator. They also offer options for single sign-on, integrations with UCF, and access to their API.

StandardFusion pricing start at $1250 for 3 users/month.

Hyperproof is risk management software software that provides organizations with a comprehensive solution for managing their risk and compliance programs. The platform offers a wide range of features that are designed to help organizations identify, assess, and mitigate risks across their operations. One of the key strengths of Hyperproof is its risk management functionality, which enables users to identify and prioritize risks based on their likelihood and potential impact. Hyperproof also allows users to create and manage risk profiles for different parts of the organization, and to track and report on risk mitigation activities.

Hyperproof's risk management functionality is built around a flexible risk assessment framework that allows users to tailor their risk management approach to their specific needs. The platform offers a range of risk assessment templates and frameworks, as well as the ability to create custom assessments. Users can also assign risk owners and set risk tolerance levels, which helps to ensure that risks are properly managed and monitored.

In addition to its risk management functionality, Hyperproof also offers a range of other features that support compliance and risk management. These include compliance monitoring, document management, task management, and reporting and analytics. Overall, Hyperproof provides organizations with a powerful and flexible platform for managing their risk and compliance programs, helping them to stay on top of their obligations and reduce the likelihood of negative outcomes.

Integrations include Slack, Zoom, Microsoft Teams, Jira Software, Asana, AWS, Azure, GitHub, OneDrive, Dropbox, Drive, Google Drive, and other options. You can also sign up with Zapier (may require a separate paid plan) to create your own custom, no-code integrations with other tools not yet available natively with Hyperproof. Or sign up to be a Hyperproof developer to leverage their API and integrate that way.

Hyperproof offers pricing and a free demo upon request.

Best risk management software for dependency visualization

The Fusion Framework System is a cloud-based, operational resilience software that operates on top of the Salesforce platform. The Fusion Framework helps organizations accelerate digital transformation of their risk management and business continuity programs by integrating data, systems, people, processes, services, and more under one platform.

The tool lets you visualize your business, products, and services from a customer perspective, creating a map of day-to-day functions within your business. The dependency visualization functionality allows organizations to recognize impacts and view relationships based on risks, processes, applications, and third-parties.

The Fusion Framework adapts to changing priorities and provides context for how risk intelligence should be applied. Users can organize their process-risk-control framework within Fusion to create a robust process profile that links to risks and controls. You can complete risk assessments, track metrics across the organization, provide step-by-step guidance to manage controls, organize and document control requirements, and resolve issues.

Fusion Framework System's integrations include Everbridge's emergency notification system and risk intelligence, Send Word Now, Onsolve, and ServiceNow.

Pricing for Fusion Framework System is available upon request.

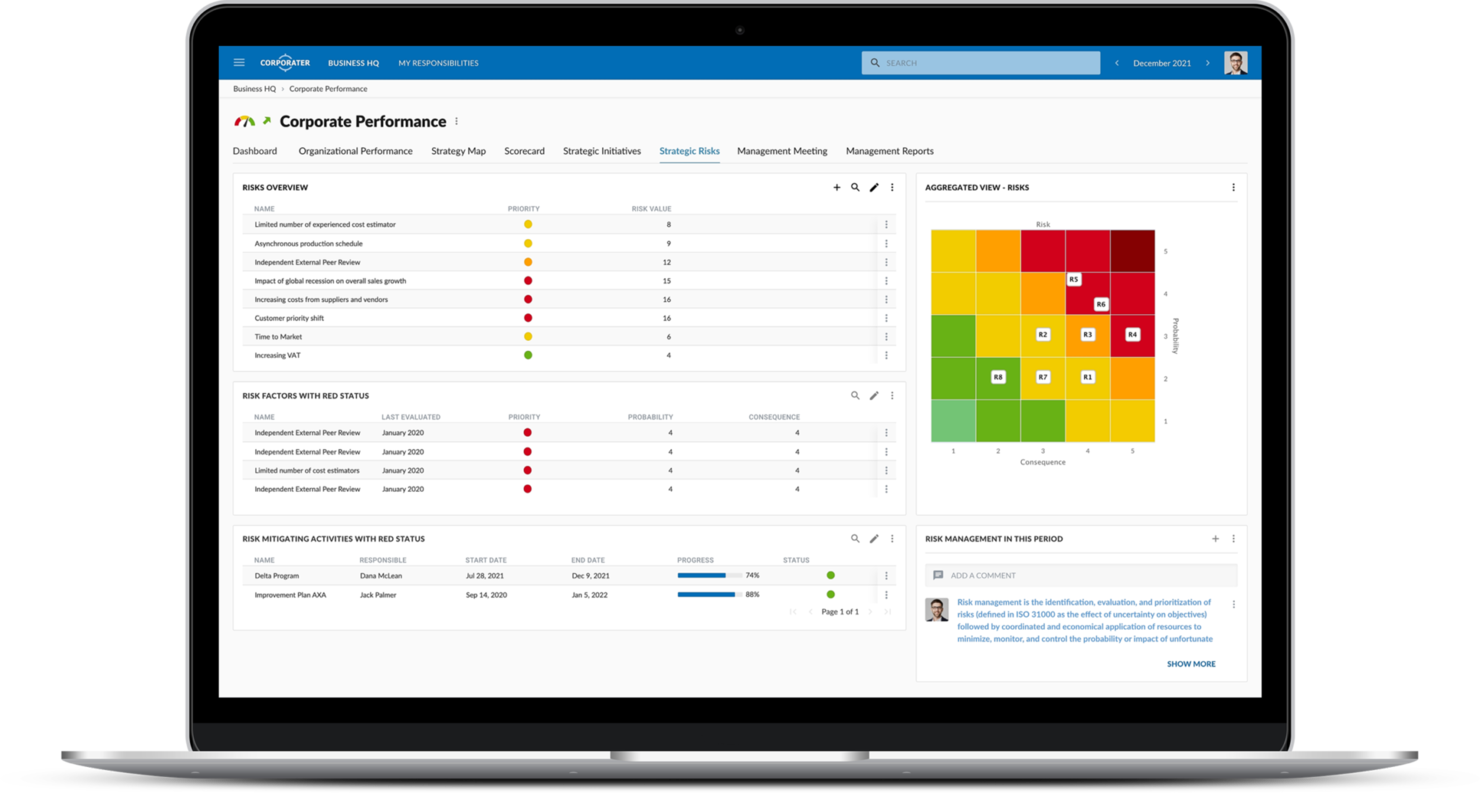

Corporater is a governance, performance, risk, and compliance (GPRC) software that can facilitate risk management operations for enterprise businesses. The software covers a wide range of uses, and its risk management functionality is robust. It can be used for operational risk management, third-party risk management, IT and web risk management, project and portfolio risk management, and more. This makes it an effective entity-wide risk management solution.

You can use the software to identify and manage risks across your business and assign risk ownership. It can help you conduct risk assessments, audits, and analyses, and implement strategies for risk mitigation. The software also has the capacity to manage various risk classifications, making it a good solution to be used across broad-spanning departments and teams.

To gain a better understanding of your risk management processes, you can generate reports through the software. Its risk dashboards give you an overview of the risks are being identified, risks currently being addressed, and risks that have been resolved. You can also gain a visual overview of potential risks with its opportunity and consequence heat maps.

A free personalized demo is available, and pricing is available upon request.

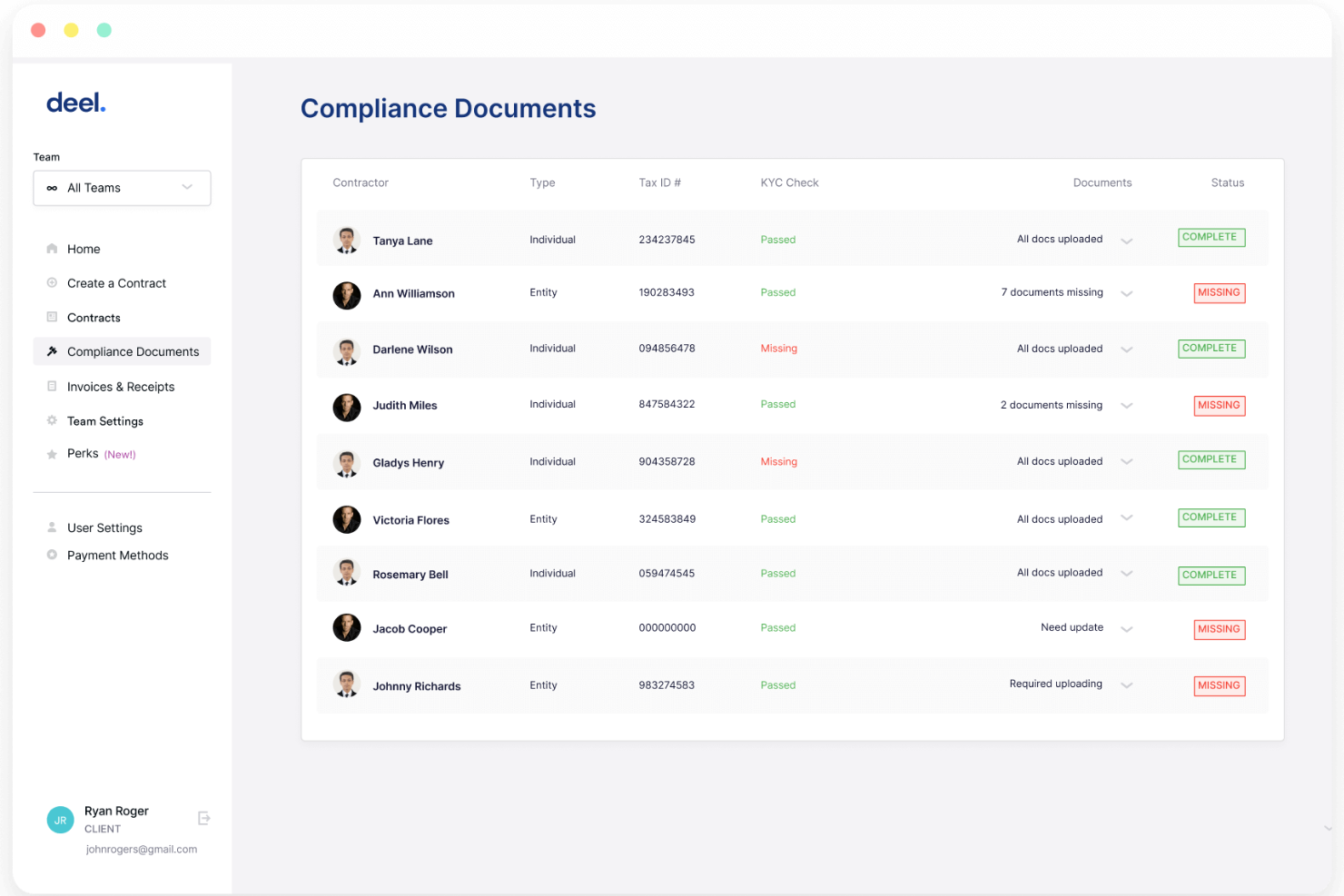

Deel offers a platform that aids companies in managing their global workforce by providing solutions for compliance, payroll, and benefits. The software facilitates the onboarding and payment of international employees, ensuring adherence to local labor laws and regulations.

For project managers working with global teams, risks associated with labor and employment must be carefully considered. Deel's platform includes features for contract management, tax compliance, and the security of employee data, which are critical components of risk management for companies with international teams. Deel also keeps users updated on local laws and regulations, so you can ensure compliance while maintaining smooth project operations.

Integrations include Slack, Brex, Google Workspace, Outlook, QuickBooks, Xero, BambooHR, Asby, Carta, Confirm, Greenhouse, JazzHR, Jira, Okta, Pangea, and more.

Deel offers flat-rate user pricing with a free demo available.

ProcessMAP helps users implement a common survey-driven methodology of risk assessment for consistency across your organization. Empower your team to collaborate to evaluate identified hazards and their impact to your organization based on user-defined measures.

ProcessMAP has a compilation of Reviqo Apps, which is a comprehensive suite of pre-configured integrations for various EHS and operational processes, from pre-startup safety reviews to ladder inspection checklists. Thus, they reviewed well in the Integrations evaluation.

One critique of the software is that a bit more flexibility by adding more incident categories would be welcomed in future updates. However, there are enough options to get the job done with a few limitations.

ProcessMAP offers pricing upon request and has a free demo.

Store, sort, and manage all your governance, risk, and compliance documents in one place with TrackMyRisks—upload and share PDFs, Office docs, images, and more. Features include automatic version control, in-system notifications, and the ability to automate document expiry reminders.

TrackMyRisks particularly excels in nixing repetitive, mundane tasks and freeing up administrative time, with features like templates for easy workflow, single source documentation, and tracking notes for convenient review.

The UX/UI for TrackMyRisks could use a bit of tweaking, as certain process pathways tend to be cumbersome and difficult to navigate. The user journey has a few speed bumps, which lost them a sliver of value in the UX category of the review criteria.

Risk management experts will especially appreciate TrackMyRisks’ privacy by design and default approach to sharing and permissions on documents and tasks.

TrackMyRisks costs from $37/month and has a free demo.

RAIDLOG.com is a web-based enterprise risk management software for project managers with best practice fields, graphical RAID views that can be shared with stakeholders, and a detailed change tracking log. Additionally, upper-level paid plans come with more advanced features, like portfolio-level aggregation and reporting of risks, actions, issues, and decisions; a reporting plug-in; customer sentiment analysis; and AI-powered risk and issue response recommendations.

RAIDLOG.com blends easy project management with risk management features. RAIDLOG.com uses custom tags and filters to sort project data by portfolio, department, client, or deliverable. You can add project due dates and budgets and track them accordingly. Once you have a project set up to your specifications, you can navigate to the risks tab. You can manually add risks, selecting from predefined categories or defining your own via a form.

RAIDLOG.com lets you assign an 'owner' to each risk item to better clarify who is responsible for monitoring it. You can add risk summaries, problem/impact statements, a risk 'state' (where in the lifecycle it might pop up), and custom tags for easy data sorting. Simple point-and-drag sliders let you define risk probability and impact levels on a scale of 1 to 100. Trigger data can be added if a certain action is known to provoke said risk. You can also add details for response strategy and risk management plans in this view.

RAIDLOG.com integrates with other systems using Zapier, which may require a separate account and paid subscription.

RAIDLOG.com currently has a special product launch price of $57 annually. They have a forever free plan for up to 5 RAID logs at any time. Regular-priced paid plans start at $99/year and come with a 30-day free trial.

Best Risk Management Software Comparison Chart

Here is a table where you can compare all the tools we just covered in the overviews.

| Tools | Price | |

|---|---|---|

| Mitratech | Pricing upon request | Website |

| New Relic | From $49/user/month | Website |

| StandardFusion | From $1500/month | Website |

| Hyperproof | Pricing upon request | Website |

| Fusion Framework System | Pricing upon request | Website |

| Corporater | Pricing upon request | Website |

| Deel | Flat rate user pricing, with free HR tool for businesses | Website |

| ProcessMAP | Pricing upon request | Website |

| TrackMyRisks | From $37/month | Website |

| RAIDLOG.com | $99/year (special: $57/year) | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Risk Assessment Software Options

Here are a few more tools that did not make the top list but are worth your consideration.

- Pims Risk

Best for planning risk responses

- cammsrisk

Best for risk management template library

- Project Risk Manager

Best for customizable system parameters

- 6clicks

Best AI-powered RMS

- @RISK

Best for Microsoft Office users

- Opture

Best risk reporting features

- IsoMetrix

Best for drag and drop capabilities

- Acumen Risk

Best for user experience and usability

- ClickUp

Hyper-customizable spaces with color coding that will make you identify risks at a glance.

- Wrike

Best for team collaboration

- LogicGate

Automate GRC processes with our library of customizable process apps.

- Resolver

Data to understand risk, make data-driven decisions, and navigate impact.

How I Picked The Best Risk Management Software

What are we looking for when we select risk management tools for review? Here’s a summary of my evaluation criteria:

User Interface (UI)

The user interface needs to be user-friendly, clean and attractive. The tool will be used to make important risk assessments that impact the project and the last thing you need is a bad UI that makes it difficult to see things.

Usability

The tool needs to be intuitive to use. Therefore, I look at how the tool supports you in mastering it through tutorials, training videos, customer support, checklists, and guides.

Integrations

I look at all the ways in which the software can connect to other cloud-based tools. Therefore, I look for any pre-built integrations, custom integration options through APIs, and third-party connectors like Zapier.

Pricing

Pricing is always a factor to consider when selecting a tool. Especially when you look at enterprise options. Therefore, I look at pricing per month on monthly plans. Additionally, I give you information on free versions, free trials you can access and any other relevant information.

Risk Assessment Software FAQ

Find answers to common questions other people ask about this topic.

What is risk management?

Risk management is the process of predicting, assessing, logging, planning for, and navigating potential and active risks that could affect your product’s financial or physical well-being.

Risk management assessment surveys everything from financial risks, legal risks, operational risks, security risks (including cybersecurity), product safety risks, economic uncertainty, accidents or disasters, and more. Compliant risk management can protect you from being blindsided by an event or disaster.

What are the key features in risk management software?

Here are a few things you must have in any good risk management solution.

- Compliance Management – Does the software understand and incorporate any legal or procedural standards that your industry is obligated to follow? Risk management software usually offers regulatory compliance management features; for specialized compliance tools, have a look at my write-up on the best GRC (governance risk compliance) tools.

- Incident Navigation – Does the tool adequately plan for, track, assess, and report on each incident of risk?

- Prediction/Estimation Capabilities – Does the software have a means to accurately predict and prevent incidents before they occur, as well as provide insights that can aid in decision-making related to each risk?

- Reporting and analytics – Are the reporting tools robust, customizable, flexible, and visually appealing? Can you build dashboards and heat maps to assess risk? Can they be exported into popular spreadsheet or other file types for review by any stakeholders involved?

What are the types of risk management?

Techniques and types of risk management include:

- Avoidance – The potential risk or vulnerability is averted by negating the activity or plan that might inflame said risk.

- Mitigation – The risk is accepted as necessary but steps are taken to reduce its impact and cause the least damage.

- Transfer – Working with a third party, usually an insurance company, the weight of the risk is transferred away from the business at hand.

- Acceptance – If the expected profit outweighs the expected risk, the level of risk may simply be accepted as a necessary evil.

What Is Enterprise Risk Management (ERM)?

ERM stands for enterprise risk management, which is the process by which a company or organization plans, organizes, and executes actions according to what path will be least risky to their capital and earnings.

What is an ERM system?

ERM software is software or a set of tools that can help an organization estimate, plan for, measure, and mitigate risks at the enterprise-level. ERM systems can help by plotting potential risks, calculating potential costs, keeping a database of risks, and more. These systems might be delivered as a SaaS or through an on-premise solution.

Who uses ERM systems?

ERM systems can be used by any type of enterprise that encounters risks that require mitigation on a regular basis. Organizations in industries with strict regulations, such as healthcare or financial services, also benefit from ERM software.

What are the benefits of risk management?

Put simply: risk management protects a company’s bottom line by mediating items that might cause harm to their capital and earnings.

What are some open source ERM software options?

If you are looking for open source ERM software, you can try: SimpleRisk, Eramba, SourceForge, Open Source Risk Engine, Open Risk, and more.

What's Next?

Whether you need supplier risk management, information risk management, legal risk management, or any number of risk navigation tools out there – there’s something on the market for you.

Related tool lists:

Have you tried out any risk analysis tools listed above? What do you use for risk control? Have you worked with many risk management companies in the past? We would love to hear your thoughts in the comments below.