10 Best Project Budget Software Shortlist

Here's my pick of the 10 best software from the 24 tools reviewed.

Get free help from our project management software advisors to find your match.

Project budget software is designed to give you a clear view of your project's financial health in real-time. It simplifies financial tracking and forecasting, ensuring you stay on budget. The key benefits include increased accuracy in financial planning and improved cost management—but it can be challenging to find the right option. With my extensive experience in digital project management, I've navigated through numerous budgeting tools, and I'm ready to share that knowledge with you.

Why Trust Our Software Reviews

We’ve been testing and reviewing project management software since 2012. As digital project managers, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different project management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our review methodology.

The 10 Best Project Budget Software Summary

| Tools | Price | |

|---|---|---|

| Microsoft Project | From $10/user/month (billed annually) | Website |

| Prophix | Pricing upon request | Website |

| Workday Adaptive Planning | Pricing upon request | Website |

| SAP Business ByDesign | From $17/user/month | Website |

| PlanGuru | From $83/user/month | Website |

| Budget Maestro by Centage | Pricing upon request | Website |

| Oracle NetSuite | Pricing upon request | Website |

| TeamGantt | From $49/user/month | Website |

| Salesforce Marketing Intelligence | From $1,250/org/month (billed annually) | Website |

| Scoro | From $26/user/month | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Project Budget Software

As you work through your unique software selection process, keep the following points in mind:

- Identify Needs: Before selecting project budget software, it's crucial to identify the specific needs of your organization. Consider the size of your projects, the complexity of your budgets, and the level of detail required for tracking and reporting.

- Ease of Use: The software should be user-friendly to ensure that all team members can utilize it effectively without extensive training. A user-friendly interface can significantly reduce the learning curve and improve the efficiency of budget management.

- Integration Capabilities: The ability to integrate with other tools and systems is essential for a cohesive workflow. Look for software that can connect with your existing accounting systems, CRM, or ERP solutions.

- Scalability: Choose software that can grow with your business. It should be able to handle an increasing number of projects and users without performance issues.

- Support and Training: Ensure that the software provider offers adequate support and training resources. This is important for resolving any issues quickly and getting the most out of your investment.

Best Project Budget Software

Selecting the right project budget software is crucial for businesses looking to effectively monitor and manage their financial resources. From features like real-time budget updates to comprehensive cost analysis tools, here are some of the best project budget softwares:

Microsoft Project is a comprehensive project management solution designed to assist project managers in developing plans, assigning resources to tasks, tracking progress, managing budgets, and analyzing workloads. It's recognized as best for robust project management due to its extensive features that cater to a wide range of project management needs, from simple task management to complex portfolio management.

Why I picked Microsoft Project:

Microsoft Project offers a powerful set of tools that can handle the demands of large and complex projects. Its ability to scale from basic project tasks to advanced portfolio management makes it distinct from other project management software. I believe it's best for robust project management because it provides the necessary tools and capabilities to manage large-scale projects effectively, ensuring that all aspects of project management are covered comprehensively.

Standout features & integrations:

Features include project planning and scheduling with familiar scheduling tools, various views like Grid, Board, and Timeline (Gantt chart), and comprehensive reporting capabilities. It also offers collaboration and communication through Microsoft Teams, co-authoring functionalities, and resource management tools.

Integrations include Microsoft Teams, OneDrive for Business, SharePoint Online, Microsoft Power BI, Microsoft Dynamics 365, Microsoft Azure, Microsoft 365 Apps, Windows 365, Microsoft Exchange, and Microsoft Outlook.

Pros and cons

Pros:

- Integration with other Microsoft products

- Scalable solutions for different project sizes

- Comprehensive project management features

Cons:

- Potential learning curve for new users

- Can be complex for small projects

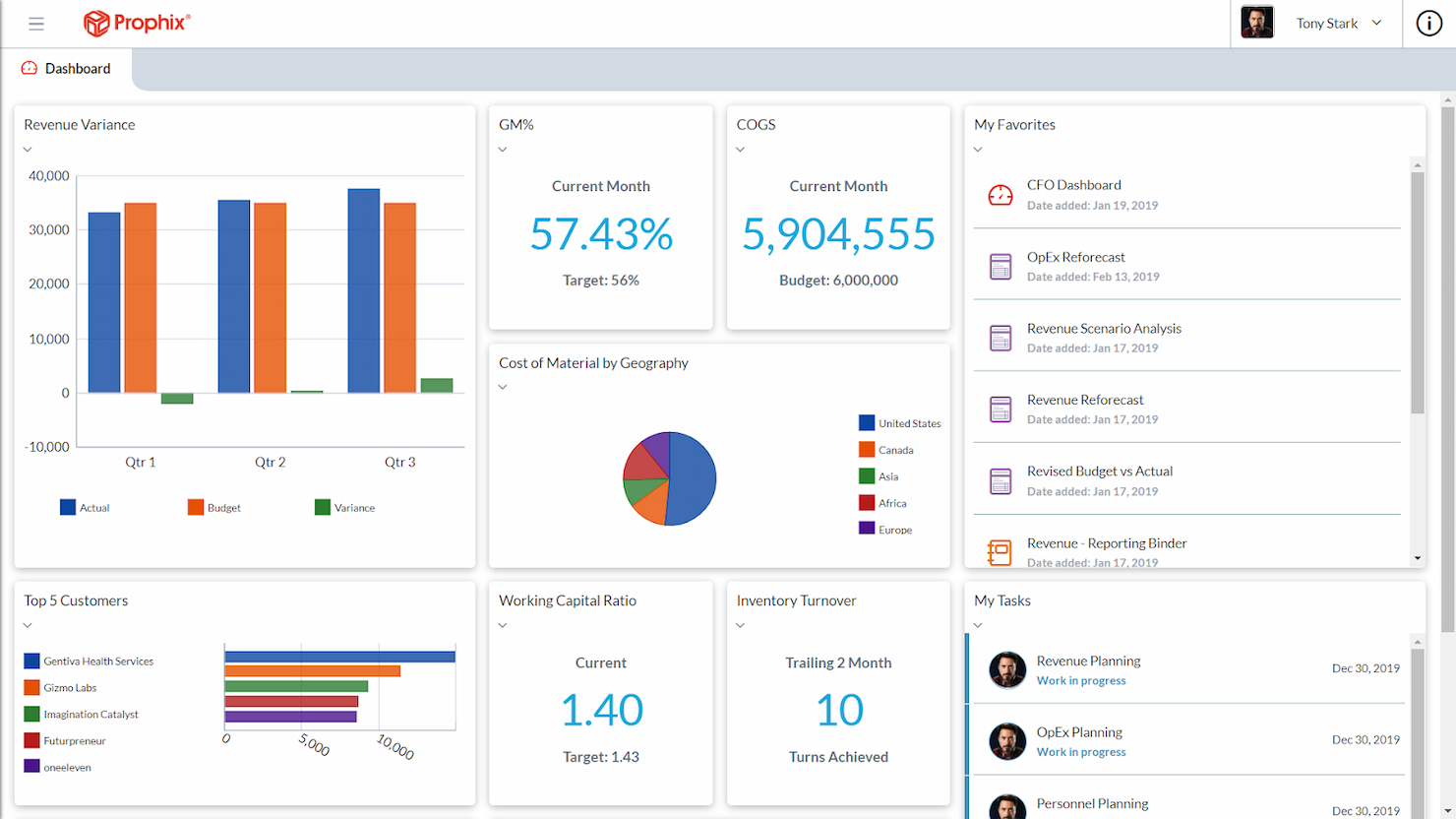

Prophix is a comprehensive tool for automating financial processes and providing insights. It stands out for its unified approach to managing financial performance, offering essential tools for budgeting, planning, forecasting, and reporting.

Why I picked Prophix:

Prophix automates financial tasks and provides actionable insights, distinguishing it from other financial tools. I consider Prophix to be best for financial performance management due to its comprehensive suite of features that cater to the complex needs of financial departments, aiding in the simplification of their operations.

Standout features & integrations:

Features include automated budgeting, financial consolidation, reporting, and scenario analysis, which are pivotal for organizations to make informed financial decisions.

Integrations include Sage, Microsoft Dynamics 365, Deltek, QAD, and more.

Pros and cons

Pros:

- Financial consolidation and scenario analysis capabilities

- Comprehensive reporting and analysis tools

- Automated financial processes

Cons:

- Steep learning curve due to detailed features

- Complex implementation

Workday Adaptive Planning streamlines complex financial and HR planning processes. It excels in enterprise planning with its robust financial and HR solutions.

Why I picked Workday Adaptive Planning:

Workday Adaptive Planning provides a comprehensive approach to financial and HR planning, which is particularly effective for large organizations. Its standout feature is the ability to handle complex, multifaceted planning processes that are typical in enterprise environments. I judge it to be best for enterprise planning because it delivers the necessary tools and scalability for extensive, strategic planning across large organizations.

Standout features & integrations:

Features include active dashboards, unlimited scenario planning, and deep integration capabilities.

Integrations include Salesforce, Slack, Microsoft Teams Zoom, Jira, ServiceNow, SAP, Oracle, NetSuite, and Microsoft Dynamics.

Pros and cons

Pros:

- Deep integration with various systems and tools

- Active dashboards and unlimited scenario planning

- Comprehensive financial and HR planning capabilities

Cons:

- Potential steep learning curve due to extensive features

- May be overly complex for smaller organizations

SAP Business ByDesign is a cloud ERP solution that scales with midsize businesses. It is recognized as best for midsize business ERP due to its comprehensive suite that unifies core business functions and offers in-depth analytics and real-time insights, which are essential for midsize businesses to compete and grow without the complexity and cost typically associated with ERP systems.

Why I picked SAP Business ByDesign:

SAP Business ByDesign provides users with a complete, integrated suite tailored to the unique needs of midsize businesses. Its cloud-based nature ensures accessibility and scalability, which is crucial for businesses in this segment. SAP Business ByDesign delivers pre-built processes across various functions, enabling companies to streamline operations and make data-driven decisions without the overhead of a more complex ERP system.

Standout features & integrations:

Features include pre-built processes for finance, sales, product management, and purchasing, all on a single unified solution. It offers agility to quickly adapt to new opportunities and real-time analytics to help improve profits and efficiency. Companies across over 160 countries rely on SAP Business ByDesign for their operations.

Integrations include various add-ons and extensions continuously developed by SAP partners, although a specific list of 10 tools that integrate natively was not provided in the available data.

Pros and cons

Pros:

- Real-time analytics and in-depth insights for better decision-making

- Cloud-based for easy access and scalability

- Comprehensive ERP suite tailored for midsize businesses

Cons:

- Performance issues may occur with large datasets

- May require additional investment for customization and add-ons

PlanGuru is a tool that simplifies complex financial planning and analysis for businesses. It stands out as the best for budgeting and forecasting due to its comprehensive features that support detailed financial strategies.

Why I picked PlanGuru:

PlanGuru hosts exceptional capabilities in financial forecasting and budgeting, which are crucial for businesses aiming to maintain financial health and growth. Its unique offering of over 20 forecasting methods and long-term projection capabilities distinguishes it from other budgeting tools. PlanGuru enables businesses to plan up to a decade ahead, ensuring they are prepared for various financial scenarios.

Standout features & integrations:

Features include multi-year forecasting, budgeting, and financial analytics which are vital for strategic planning. The software's integration with popular accounting systems and its robust reporting tools make it a valuable asset for financial management.

Integrations include QuickBooks, QuickBooks Online, Xero, Excel, Advanced Reporting Excel Add-in, In-App Reporting Tools, Export Reports & Dashboards to PDF, Word, Excel, Permission-based User Access Levels, In-App Help Guides, Video Tutorials & Knowledge Base, PlanGuru University.

Pros and cons

Pros:

- Long-term financial projection capabilities

- A variety of forecasting methods are available

- Comprehensive financial statement forecasting

Cons:

- Complexity may be overwhelming for smaller businesses

- Higher cost for additional users

Budget Maestro by Centage streamlines the financial planning and analysis process. It stands out for ensuring budget accuracy through a formula-free methodology.

Why I picked Budget Maestro by Centage:

Budget Maestro has a distinctive approach to financial planning, which emphasizes accuracy and eliminates common errors associated with manual formulas. This tool is best for budget accuracy because it automates the budgeting process, reducing the potential for human error and increasing the reliability of financial forecasts.

Standout features & integrations:

Features include automated financial consolidation, rapid and precise budget creation, and advanced forecasting capabilities that do not rely on manual formulas.

Integrations include Intuit QuickBooks, Microsoft Dynamics 365, Oracle NetSuite, Sage, Abila, SAP, Syspro, and more.

Pros and cons

Pros:

- Access to FP&A expert advisors for support

- Quick setup with built-in accounting rules and logic

- Automated, formula-free budgeting and forecasting

Cons:

- May require training due to feature complexity

- Not ideal for large-scale organizations

Oracle NetSuite is a comprehensive cloud ERP solution for businesses. It's best for cloud-based business management due to its unified suite of applications.

Why I picked Oracle NetSuite:

Oracle NetSuite's robust cloud-based ERP capabilities streamline business processes and provide real-time visibility into operations. Its ability to adapt and scale with businesses makes it stand out from other cloud-based management solutions. Oracle NetSuite offers a complete suite of applications that manage everything from financials and operations to customer relations, all on the cloud.

Standout features & integrations:

Features include financial management, enterprise performance management, order management, inventory management, and supply chain management. It also offers CRM, e-commerce, and professional services automation, making it a versatile tool for various business needs.

Integrations include Shopify, BigCommerce, Adobe Commerce, WooCommerce, eBay, Walmart, Amazon Seller Central, Amazon Vendor Central, Shopify POS, and Oracle Simphony POS.

Pros and cons

Pros:

- Scalability to grow with the business

- Real-time visibility into business operations

- Comprehensive suite of business management applications

Cons:

- The breadth of features may be overwhelming for users new to ERP systems

- May be complex to implement for smaller businesses

TeamGantt is a tool that facilitates project planning and team collaboration. It is recognized as the best for Gantt chart collaboration due to its user-friendly design and comprehensive visualization capabilities.

Why I picked TeamGantt:

TeamGantt is popular for its exceptional Gantt chart collaboration features, which are pivotal for effective project management. Its ease of use and robust visualization tools set it apart from other project management software. TeamGantt enables teams to collaborate on a shared timeline, fostering clear communication and project alignment.

Standout features & integrations:

Features include a drag-and-drop Gantt chart interface, allowing for quick adjustments to project timelines. It also offers workload management, time tracking, and easy collaboration tools. The software provides a clear overview of all projects, which is crucial for resource allocation and progress tracking.

Integrations include Slack, Trello, Dropbox, Zapier, Google Drive, Google Calendar, Microsoft Teams, Asana, Basecamp, and Jira.

Pros and cons

Pros:

- Robust collaboration tools

- Comprehensive project overview

- Intuitive Gantt chart interface

Cons:

- Provides basic reporting capabilities

- Higher cost for small teams

Salesforce Marketing Intelligence offers a comprehensive platform for unifying, visualizing, and activating marketing data.

Why I picked Salesforce Marketing Intelligence:

Salesforce Marketing Intelligence offers robust analytics capabilities that stand out in the realm of marketing data management. It's the best for marketing analytics because it provides a unified platform that simplifies complex data handling, enabling businesses to make informed marketing decisions. I believe this tool is best for marketing analytics due to its ability to integrate various data sources, providing a holistic view of marketing performance.

Standout features & integrations:

Features include data integration, harmonization, visualization, and AI insights. These features empower marketers to gain a comprehensive understanding of their campaigns and make data-driven decisions.

Integrations include G Suite, Slack, Quickbooks, MailChimp, LinkedIn, Docusign, Jira Software, HelloSign, CodeScience, ActiveCampaign, Dropbox, and more.

Pros and cons

Pros:

- Flexible editions and pricing to accommodate business needs

- Advanced data visualization and AI tools

- Unified platform for marketing data management

Cons:

- May experience integration problems with external systems

- High starting price point

Scoro is a comprehensive work management software designed to cater to the unique needs of service businesses. It is best for end-to-end work management because it provides a unified platform that streamlines projects, simplifies quoting, automates billing, and optimizes utilization.

Why I picked Scoro:

Scoro stands out as a single, integrated solution for managing all aspects of work within service-oriented businesses. Its ability to consolidate multiple functions into one system makes it distinct from other project budget software. I believe Scoro is best for end-to-end work management due to its comprehensive feature set that covers the entire project lifecycle, from initial quoting to final billing, ensuring that all stages of work are efficiently managed within one platform.

Standout features & integrations:

Features include project management, quoting and budgeting, sales and CRM, resource planning, retainers, time tracking, and reporting and dashboard. These features are designed to deliver projects efficiently, manage customer accounts, plan work for optimal utilization, and provide detailed insights on progress and results.

Integrations include Google Calendar, MS Exchange, Xero, QuickBooks, Sage Intacct, Exact Online, Expensify, Stripe, Jira, and more.

Pros and cons

Pros:

- Positive reviews from over 1,000 users

- Comprehensive feature set for service businesses

- Unified platform for end-to-end work management

Cons:

- May have a learning curve for new users due to its extensive features

- A minimum of 5 users is required for the subscription

Other Project Budget Software to Consider

The above options aren’t the only project budget software available. Below are additional softwares that were shortlisted—however, they’re still worth looking further into.

Related Project Budget Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- Project Management Software

- Resource Management Software

- Workflow Automation Software

- Time Tracking Software

- Task Management Software

- Collaboration Tools

- Gantt Chart Maker

- Productivity Tools

- Project Tracking Software

- Project Scheduling Software

Project Budget Software Selection Criteria

When selecting project budget management tools, it's crucial to consider both functionality and how well the tool addresses specific use cases that are most relevant to buyers. The criteria should reflect the needs and pain points of users, as well as the primary purposes for which project budget management tools are utilized.

As an expert who has personally tried and researched these tools, I have developed a set of criteria that are critical for evaluating and selecting the right project budget management tool.

Core Functionality: 25% of total weighting score

- Budget creation and allocation

- Expense tracking

- Financial reporting

- Forecasting and analysis

- Integration with other financial systems

Additional Standout Features: 25% of total weighting score

- Innovative data visualization tools for budget analysis

- Real-time collaboration capabilities for team budget management

- Advanced predictive analytics for financial forecasting

- Customizable alerts for budget thresholds

- Integration with advanced project management features

Usability: 10% of total weighting score

- Intuitive navigation and user interface

- Clear and concise dashboard design

- Responsive design for mobile and tablet use

- Simplified data entry methods

- Visual cues for important financial data

Onboarding: 10% of total weighting score

- Availability of step-by-step guides

- Access to a knowledge base or FAQ section

- Interactive tutorials or product tours

- Template libraries for quick setup

- Customer service responsiveness during the onboarding phase

Customer Support: 10% of total weighting score

- Multiple channels of support (email, phone, chat)

- Availability of a dedicated account manager

- Responsiveness and resolution times

- Community forums or user groups

- Regular updates and maintenance communication

Value For Money: 10% of total weighting score

- Transparent pricing models

- Scalability of the tool to different project sizes

- Free trials or demos available

- Inclusion of essential features in the base price

- Additional costs for upgrades or add-ons

Customer Reviews: 10% of total weighting score

- Overall user satisfaction and ratings

- Frequency of positive versus negative feedback

- Specific praises or criticisms that recur

- User testimonials on the tool's impact

- Consistency of the tool's performance over time

By meticulously assessing these criteria, I ensure that the project budget management tool selected not only meets the standard requirements but also provides additional value through unique features, excellent usability, effective onboarding, reliable customer support, and overall value for money.

Trends for Project Budget Software in 2024

Here are some of the top trends in project budget software that I’m noticing in 2024:

- Integration with Real-Time Data Analytics: Project budget software now integrates with real-time data analytics. This allows for immediate insights into spending and resource allocation. It's important for making quick, informed decisions.

- Emphasis on User-Friendly Interfaces: User-friendly interfaces are becoming a priority. They simplify the user experience and reduce the learning curve. This trend is crucial for wider adoption across various skill levels.

- Enhanced Collaboration Features: Collaboration features are being enhanced in project budget software. Teams can now work together more effectively on budgeting tasks. This is significant for maintaining transparency and accountability.

- Predictive Budgeting Using AI: Artificial intelligence is being used for predictive budgeting. AI analyzes past data to forecast future spending trends. This is interesting for its potential to prevent budget overruns.

- Mobile Accessibility: Mobile accessibility is a growing trend. Project budget software is now available on smartphones and tablets. This is important for on-the-go access and updates.

What is Project Budget Software?

Project budget software is a digital tool designed to assist in planning, tracking, and managing the financial aspects of projects. It's used by project managers, finance teams, and stakeholders to maintain control over project costs and ensure financial objectives are met. This software is essential for users who need to create accurate budget forecasts, monitor expenditures, and manage project finances to avoid overspending and maximize financial resources.

Features of Project Budget Software

When selecting project budget software, it's crucial to consider the features that will support effective financial management throughout the lifecycle of a project. The right set of tools can make a significant difference in maintaining control over costs, forecasting expenses, and ensuring the financial health of a project.

Here are the most important features to look for:

- Real-Time Budget Tracking: This feature allows for immediate visibility into financial performance. It's important because it enables project managers to make informed decisions quickly, preventing budget overruns.

- Forecasting Tools: These tools predict future spending and revenue. They are essential for planning and preparing for upcoming financial needs or identifying potential shortfalls.

- Expense Management: This feature simplifies the recording and tracking of project expenses. It's crucial for maintaining accurate financial records and ensuring that all costs are accounted for.

- Cost-to-Completion Tracking: This functionality provides an estimate of the total cost required to complete the project. It's vital to assess whether the project will stay within budget through to its conclusion.

- Time Tracking Integration: This feature links time spent on project tasks with budgetary considerations. It's important because it helps in understanding labor costs and their impact on the overall budget.

- Customizable Reports: The ability to create tailored reports is key for analyzing different aspects of the project budget. It allows for a deeper understanding of financial data and supports strategic decision-making.

- Multi-Currency Support: For global projects, this feature is essential as it handles different currencies and exchange rates. It ensures accurate financial management across international borders.

- Role-Based Access Control: This feature restricts budget access based on user roles. It's important to maintain data integrity and ensure that sensitive financial information is only accessible to authorized personnel.

- Integration Capabilities: The ability to integrate with other project management tools is crucial for a holistic view of project health. It allows for the synchronization of financial data with other project metrics.

- Scalability: This feature ensures that the software can grow with the project or organization. It's important to adapt to changing project scopes and sizes without the need for new software.

Selecting project budget software with these features can significantly support the financial management of any project. These tools not only provide clarity and control over project finances but also contribute to the overall success and profitability of projects.

Benefits of Project Budget Software

Project budget software is an invaluable tool for businesses and individuals looking to maintain control over their project finances. By integrating such software into their operations, users can experience a range of advantages that contribute to the efficient management of project costs and resources. Here are a few of the primary benefits that project budget software offers:

- Real-Time Budget Monitoring: Project budget software enables users to track expenses as they occur, ensuring that all financial activity is recorded and analyzed in real time. This immediate insight helps prevent overspending and allows for timely adjustments to the budget.

- Forecasting and Analysis: With the ability to predict future spending and analyze past data, project budget software assists in making informed financial decisions. This foresight can lead to better resource allocation and can help avoid potential financial pitfalls.

- Enhanced Collaboration: Teams can work together more effectively when they have access to shared budget information. Project budget software facilitates this collaboration by providing a centralized platform for budget-related communication and decision-making.

- Streamlined Cost Management: The software simplifies the process of managing project costs by automating many of the tasks associated with budget tracking. This automation reduces the likelihood of human error and saves time that can be invested in other project areas.

- Improved Financial Reporting: Generating comprehensive financial reports becomes much easier with project budget software. These reports are crucial for stakeholders to understand the financial health of a project and make strategic decisions accordingly.

The adoption of project budget software can lead to better financial control, more accurate planning, and improved overall project outcomes. By leveraging these tools, organizations can ensure that their projects are completed within budget and that financial risks are minimized.

Costs and Pricing of Project Budget Software

Project budget software is designed to help project managers and teams plan, track, and manage project finances effectively. However, the pricing for these software solutions can vary widely based on the features offered, the number of users, and the level of support provided.

Below is a summary of the plan options and their pricing for project budget software, based on the research conducted:

Plan Comparison Table for Project Budget Software

| Plan Type | Average Price | Common Features |

| Free | $0 (Free) | Basic task management, limited users, native calendar, kanban board, and limited storage space |

| Individual | $3.66 per month | Advanced task management, calendar views, priority setting, third-party integrations, and limited storage |

| Small Business | $8.90 per month/user | Gantt chart view, collaboration tools, document sharing, increased support, and more storage |

| Medium Business | $16.88 per month/user | Advanced security, unlimited users, comprehensive project views, and real-time reporting |

| Enterprise | Custom Pricing | Negotiable pricing, best customer support, and all-inclusive feature set. Often requires minimum users |

When selecting a project budget software plan, buyers should consider the size of their team, the complexity of their projects, and the specific features they require to manage their project budgets effectively. Buyers should carefully evaluate each plan's features against their budget to make an informed decision.

Project Budget Software for Clients FAQs

Here are some commonly asked questions about project budget software for clients.

Is project budget software suitable for small businesses?

Certainly, project budget software is designed to cater to the needs of small businesses as well. It offers scalable solutions that help manage workloads efficiently, ensuring that projects are delivered within budget and on time.

What are the risks of not using project budget software?

Forgoing the use of project budget software can result in inaccurate budget estimates, overspending, a lack of financial control, cost overruns, and challenges in tracking project spending effectively. These risks can have a significant negative impact on the success of a project and the financial stability of an organization.

Which software is best used to create a budget?

The best software for creating a budget will depend on the specific needs of the user or organization. Timeular is noted for its robust budgeting features and excellent project management capabilities, which are conducive to effective task management.

How do you manage a software project budget?

To manage a software project budget, one should create a detailed project outline, list every required resource, assign a cost to each resource, include a contingency, document the budget, seek approval, and continuously monitor and adjust the budget as necessary throughout the project lifecycle.

What’s Next?

Subscribe to the DPM newsletter to get regular updates when we publish fresh how-to guides and articles on digital project management topics.