Best Project Management Software with Financial Tracking Shortlist

Get free help from our project management software advisors to find your match.

You’re looking for a project management tool to help you manage your projects and project finances all-in-one. After all, integrated features such as budget management, invoicing, and financial overviews can help you to make informed decisions and ensure profitability. However, with so many project management tools available, with and without financial tracking features, finding the right software can be both frustrating and time-consuming.

Here, I draw on my extensive experience as a project manager to shortlist the best PM software with financial tracking on your behalf. After narrowing down your list to just tools with financial tracking capabilities, I additionally included information about each tool’s features and best use cases to make finding the right software for you quick and easy.

Why Trust Our Reviews

We’ve been testing and reviewing project management software since 2012. As project managers ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different project management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our review methodology.

Best Project Management Software with Financial Tracking Summary

| Tools | Price | |

|---|---|---|

| Bonsai Agency Software | $10/user/month | Website |

| Microsoft Project | From $10/user/month (billed annually) | Website |

| Forecast | Pricing upon request | Website |

| ProProfs Project | From $39.97/month (billed annually) + free plan available | Website |

| Teamwork | From $11/user/month (billed annually) | Website |

| ProofHub | From $45/month (billed annually) | Website |

| Adobe Workfront | Pricing upon request | Website |

| Oracle NetSuite | Pricing upon request | Website |

| Clarizen | Pricing starts at $45/user/month | Website |

| SAP Enterprise Portfolio and Project Management | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Project Management Software with Financial Tracking

As you work through your unique software selection process, keep the following points in mind:

- Integration Capabilities: Be sure that your chosen software can integrate with existing systems, such as accounting software, CRMs, and other tools, in order to maintain a cohesive flow of financial data across platforms.

- Real-Time Budget Monitoring: Look for software that provides real-time insights into project budgets and expenses. This feature can help prevent budget overruns by alerting managers when spending approaches the set threshold.

- Customizable Reporting: The ability to create custom financial reports can be essential for analyzing project performance and making informed decisions. Different stakeholders may require various data points, so customizable reports can help you easily cater to each stakeholder’s needs.

- User-Friendly Interface: Choose software with an intuitive interface that doesn't require extensive training. A user-friendly interface ensures that all team members can track and manage project finances without confusion, regardless of their level of tech-savviness.

- Scalability: Select software that can grow with your business. Whichever software you choose should be able to handle an increasing number of projects and users without performance issues.

Best Project Management Software with Financial Tracking Reviews

Discover the strengths and limitations of leading project management tools with financial tracking capabilities. My detailed reviews provide insights into the features and ideal use cases for each software.

Bonsai is a business management platform with project, finance, resource, and client management features. It's built for agencies, consultancies, and other professional services businesses.

Why I picked Bonsai: This platform is well-suited to the needs of agencies that want to consolidate multiple elements of their business management. It offers well-rounded project and task management features like task assignments, deadlines, Kanban boards, and collaboration tools. These all integrate directly with its other capabilities.

Beyond project management, the software has tools for drafting proposals, managing contracts, generating invoices, and processing client payments. With client portals available, it helps client-facing businesses maintain efficiency and reduce errors in budget management.

Bonsai Standout Features & Integrations

Features include multiple currency and tax settings, which supports agencies working with international clients. The time tracking tool allows teams to monitor billable and non-billable hours and manage team member workloads. Reporting also supports financial tracking and forecasting, helping users maintain profitability.

Integrations include Gmail, Google Calendar, Zapier, Slack, QuickBooks Online, Calendly, ClickUp, Trello, Google Drive, Google Sheets, Xero, HubSpot, and more.

Pros and cons

Pros:

- Automations to streamline repetitive tasks

- Client portals available

- Designed specifically for agencies

Cons:

- Some integrations are locked to higher pricing tiers

- Somewhat limited in scalability

Microsoft Project is a comprehensive project management solution designed to assist teams in planning, executing, and analyzing project work.

Why I Picked Microsoft Project: I chose Microsoft Project for its exceptional cost tracking capabilities. It allows users to create detailed project budgets, track actual costs against planned expenses, and manage resource rates to monitor overall project financial performance.

Moreover, Microsoft Project’s precision and integration with existing Microsoft tools make it indispensable for large organizations needing detailed financial oversight of projects. The platform’s ability to handle complex project portfolios and integrate cost management directly within a familiar ecosystem also make it particularly unique in the market.

Standout features & integrations:

Features include budgeting, forecasting, and actual spend tracking. The tool’s ability to integrate cost data with scheduling and resource management also ensures that project leaders have a holistic view of project health and can make adjustments proactively.

Integrations include Microsoft Excel, Microsoft Teams, OneDrive, SharePoint, Power BI, Azure DevOps, Microsoft Dynamics 365, Outlook, Microsoft Power Automate, and Yammer.

Pros and cons

Pros:

- Detailed financial reporting

- Integrates with Microsoft ecosystem

- Advanced scheduling and cost tracking

Cons:

- Designed primarily for larger enterprises

- Higher learning curve

Forecast is a project management tool that leverages AI-driven financial forecasting and resource management to help users proactively address potential budget and resource issues.

Why I Picked Forecast: I chose Forecast for its strong emphasis on AI-driven predictive budgeting insights, which set it apart from simpler project management solutions that lack deep financial analysis. This includes AI-powered algorithms that predict project cost overruns and resource needs effectively.

Additionally, the platform's advanced analytics and reporting tools provide detailed financial overviews, enabling informed decision-making and proactive budget management.

Standout features & integrations:

Features include budget tracking, real-time financial insights, and automated cost predictions, which help teams accurately estimate project expenses and track financial performance. Moreover, Forecast’s invoicing feature is integrated, allowing expenses to be billed accurately to clients as incurred.

Integrations include Google Drive, Trello, Slack, GitHub, GitLab, Jira, QuickBooks, Xero, Salesforce, and Microsoft Teams.

Pros and cons

Pros:

- Real-time financial insights

- Integrated invoicing system

- AI-driven budget forecasts

Cons:

- Limited customization options

- Complex features for beginners

ProProfs Project is a comprehensive project management solution ideal for small to medium-sized businesses aiming for centralized project and financial management.

Why I Picked ProProfs Project: I chose ProProfs Project for its unique blend of simplicity and power, which make it an effective solution for small and medium-sized enterprises looking to streamline both project and financial management. It offers user-friendly features such as task management, collaboration tools, and detailed reporting.

The platform also includes financial tracking capabilities such as time tracking, expense tracking, and invoicing capabilities.

Standout Features & Integrations:

Features include an intuitive dashboard that facilitates easy monitoring of project timelines and budgets. The task dependency feature is also useful, allowing teams to sequence tasks effectively, ensuring smooth project progression.

Integrations include Salesforce, Zendesk, Slack, Xero, QuickBooks, G Suite, Microsoft Office, MailChimp, Dropbox, and Box.

Pros and cons

Pros:

- Comprehensive reporting tools

- Free plan available for up to five users

- Intuitive user interface

Cons:

- Minimal third-party integrations

- Limited customization options

Teamwork is a project management tool that provides a complete collection of capabilities tailored exclusively to the demands of agencies, consulting services, professional services, IT services, and design and engineering organizations.

Why I Picked Teamwork: I chose Teamwork because it stands out as a highly customizable solution for client services businesses. I believe Teamwork is the best tool for client work management because it provides a centralized platform for managing all aspects of client relationships, from project inception to completion, including financial tracking and resource optimization.

Teamwork can also help users plan projects, allocate resources, and facilitate project collaboration.

Standout features & integrations:

Features include time tracking, resource management, project templates, and various views such as Kanban boards and Gantt charts. It also offers built-in messaging tools, customizable notifications, project organization, and financial tracking capabilities.

Integrations include Slack, Harvest, Feedbucket, Microsoft Office, Quickbooks, ByBrand, Stripe, Atarim, Parallax, and HubSpot.

Pros and cons

Pros:

- Offers a free plan for small teams

- Integrates with popular tools like Slack and MS Teams

- Customizable for client services businesses

Cons:

- Limited storage on the free plan

- The starting price requires a minimum of 3 users

ProofHub is a project management tool that enables finance teams to collaborate and track their projects using an all-in-one tool.

Why I Picked ProofHub: I picked ProofHub for its versatility and integrated financial tracking features, including time tracking, expense management, and budgeting tools. These features enable teams to monitor project costs, track billable hours, and manage budgets effectively, providing comprehensive financial oversight alongside comprehensive task management, collaboration, and reporting functionalities.

Standout features & integrations:

Features include real-time budget updates and expense reports that ensure financial control throughout the project lifecycle. The tool also offers customized reports, which are essential for financial analysis and forecasting.

Integrations include Google Calendar, Google Drive, OneDrive, Dropbox, Box, Slack, FreshBooks, QuickBooks, Outlook, and iCal.

Pros and cons

Pros:

- Customized financial reports

- Real-time budget updates

- Flat rate for unlimited users

Cons:

- Limited third-party integrations

- No free plan

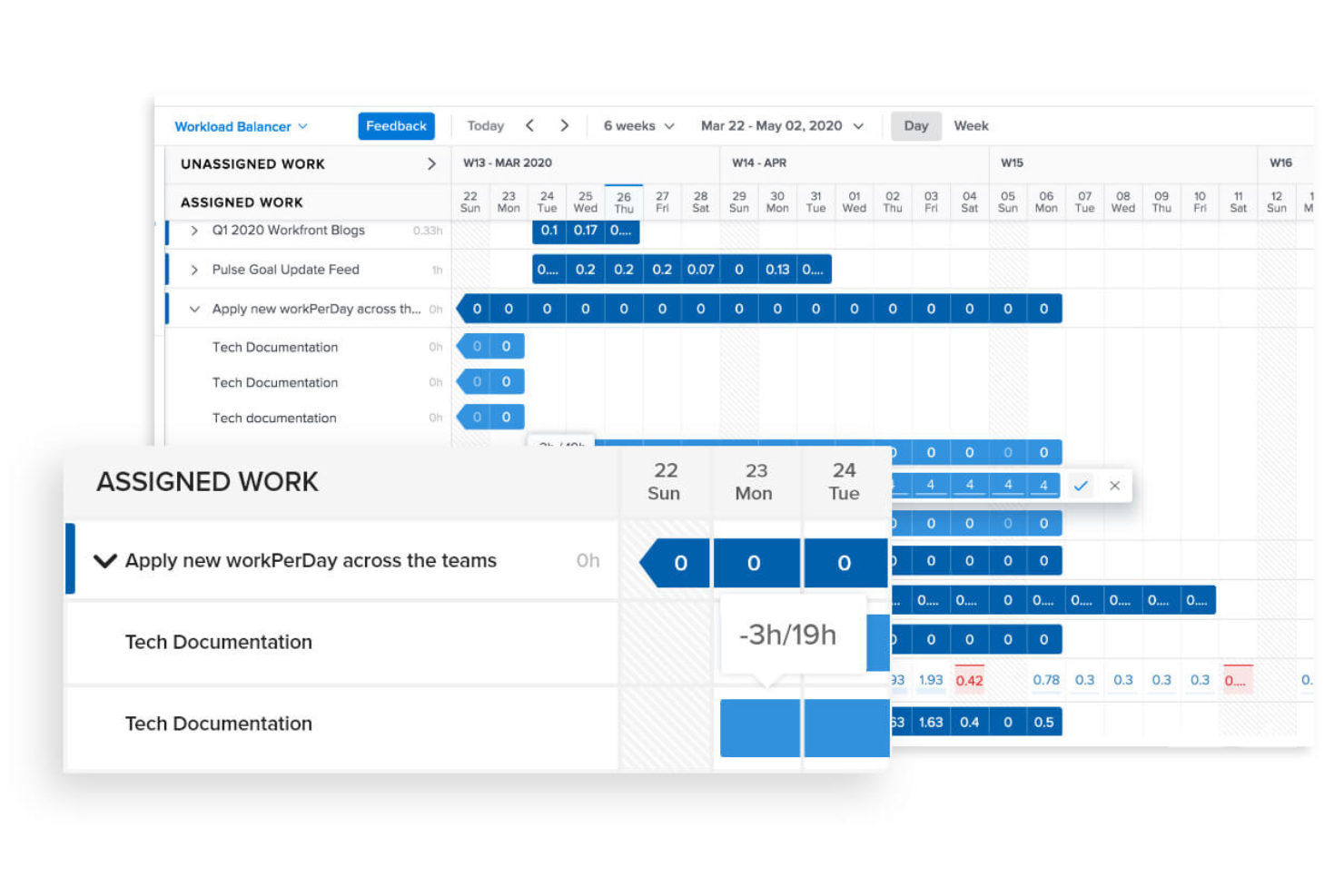

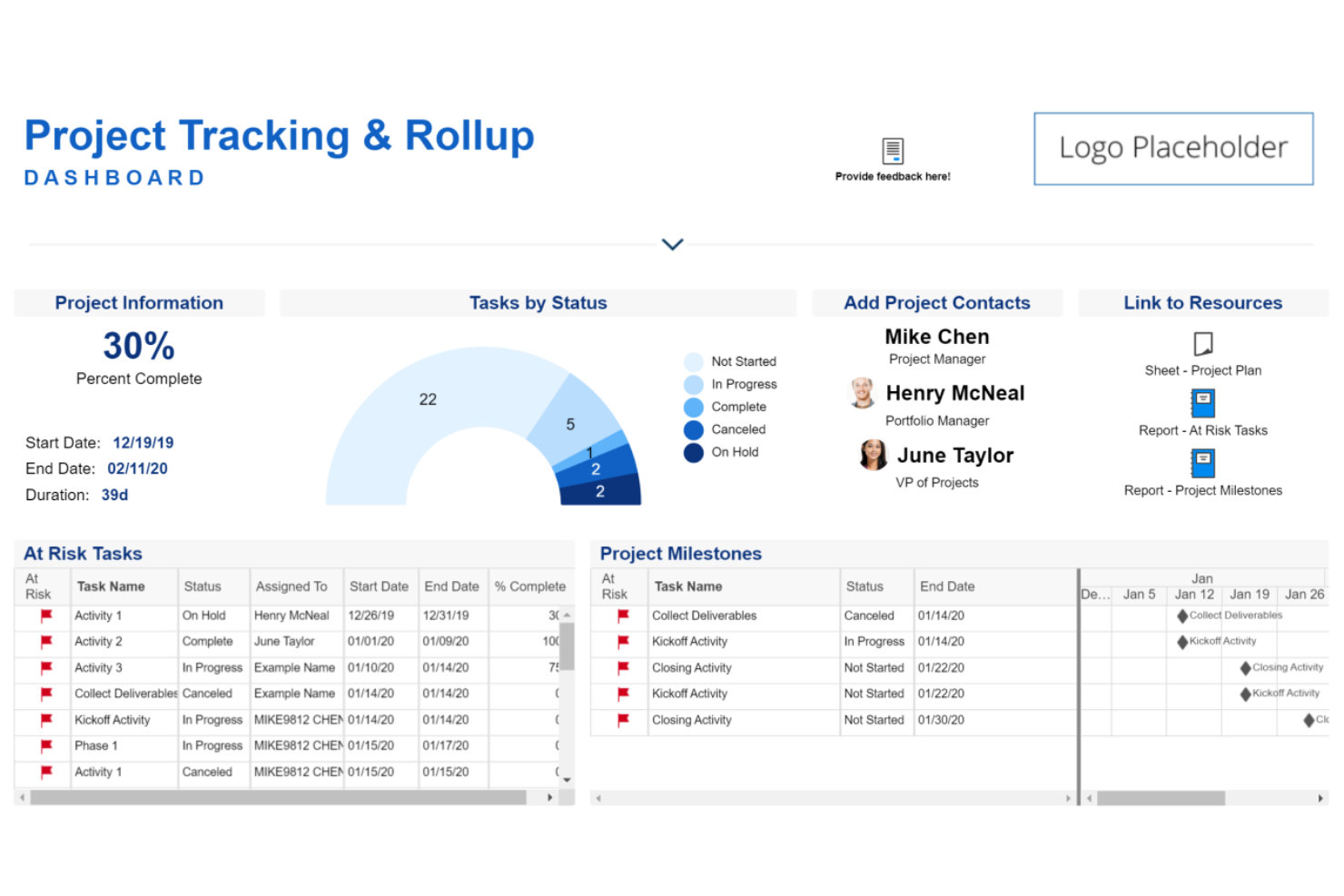

Adobe Workfront is an enterprise work management solution that has strong budget and expenditure management features that provide detailed visibility into project costs and resource utilization.

Why I Picked Workfront: I chose Adobe Workfront for this list because of its comprehensive approach to project management, which includes financial tracking as a core component. I particularly believe that Adobe Workfront is the best tool for financial tracking because it integrates financial data easily into the project management workflow, ensuring that budgeting and cost management are central to the project planning and execution process.

Additionally, Adobe Workfront can handle complex project portfolios and provide detailed financial insights.

Standout features & integrations:

Features include work automation, goal alignment, scenario planning, and workflow management. Its real-time dashboards and reporting capabilities also allow for effective tracking of project expenses and budget performance.

Integrations include G-suite, Adobe Creative Cloud, Adobe Experience Manager, Microsoft Outlook, JIRA, Slack, Salesforce, Microsoft Teams, Google Drive, and Box.

Pros and cons

Pros:

- Scalable solution for various project types and sizes

- Real-time dashboards and reporting for budget and expense management

- Comprehensive financial tracking within project management

Cons:

- Extensive feature set may require a learning curve

- Pricing information requires direct inquiry

Oracle NetSuite is an all-in-one business platform that simplifies enterprise resource planning with a comprehensive suite of cloud-based applications.

Why I Picked Oracle NetSuite: I selected Oracle NetSuite for its all-encompassing cloud-based suite that addresses a broad spectrum of business processes. As such, I regard Oracle NetSuite as the best tool for cloud business management because it delivers a holistic set of tools that enable businesses to manage their operations in the cloud, ensuring consistent data and access across the enterprise.

The tool also integrates smoothly with NetSuite's accounting system, providing users with the ability to track and manage project finances, expenses, and profitability comprehensively.

Standout features & integrations:

Features include instantaneous team collaboration, immediate insights into project performance, mobile access, and risk management tools.

Integrations include CSV Import, SuiteTalk SOAPWeb Services, SuiteTalk REST Web Services, and RESTlets.

Pros and cons

Pros:

- Smooth integration with NetSuite's financial system

- Immediate visibility into project status and financials

- Comprehensive suite for cloud-based business management

Cons:

- Potential for significant implementation costs depending on business complexity

- Users must contact sales for comprehensive pricing and module details

Clarizen is a project management software that enables effective management of schedules and resources.

Why I picked Clarizen: I chose Clarizen for its exceptional integration of project management with financial tracking. In comparing various tools, Clarizen’s ability to provide real-time updates and detailed financial reports makes it stand out as an effective tool for maintaining budget control and project transparency.

I also believe this tool would especially useful for businesses that prioritize financial accuracy and project efficiency, as it excels in easily linking project milestones to budgetary allocations, ensuring every project stays on track financially.

Standout features & integrations:

Features include advanced scheduling capabilities that automate task timelines and dependencies. Clarizen also provides dynamic resource allocation tools coupled with in-depth analytics that deliver actionable insights into project performance and financial health.

Integrations include Salesforce, Jira, SharePoint, Box, OneLogin, iHub, Ziflow, and Gainsight.

Pros and cons

Pros:

- Customizable workflows

- Real-time collaboration features

- Comprehensive integration options

Cons:

- Mobile experience is limited

- Interface can be complex

Best for centralized project oversight

SAP Enterprise Portfolio and Project Management is a comprehensive tool designed to manage projects across an entire organization.

Why I Picked SAP Project Management: I chose SAP Enterprise Portfolio and Project Management for this list because of its vigorous capabilities in handling company-wide projects from a centralized platform. Its standout feature is its integration of finance and logistics information, which is essential for maintaining transparency and control over project costs and schedules.

Moreover, I believe SAP Enterprise Portfolio and Project Management is the best tool for centralized project oversight due to its ability to provide a complete view of capital expenditures and performance. The platform also provides optimized resource management capabilities that are great for preventing project bottlenecks.

Standout features & integrations:

Features include portfolio management, tracking of project cost and schedule, project coordination across distributed teams, automated project controlling, optimized resource utilization, project financial planning issue, and change management risk management.

Integrations include SAP ERP (Enterprise Resource Planning), SAP SuccessFactors, SAP Ariba, SAP Analytics Cloud, and Microsoft Project.

Pros and cons

Pros:

- Machine learning for accurate cost reporting and analysis

- Integration of finance and logistics information

- Centralized management of company-wide projects

Cons:

- Requires integration with other SAP components for full functionality

- Pricing information is not readily available

Other Project Management Software with Financial Tracking

Below is a list of additional project management software with financial tracking that did not make it to the top list, but are still definitely worth checking out.

Related Project Management Software

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- Project Management Software

- Resource Management Software

- Project Scheduling Software

- Time Tracking Software

- Task Management Software

- Project Tracking Software

Selection Criteria for Project Management Software with Financial Tracking

Selecting project management software with financial tracking is a critical but difficult decision that hinges on both finding a solution that effectively aligns with your needs and narrowing down the available options to find the most suitable choice. Overall, the right software should address common challenges, such as budget overruns, cost allocation, and financial reporting, while also keeping you informed about your project's overall financial performance.

In my extensive experience with these tools, I have developed a set of criteria that I use to evaluate and choose the best fit for an organization's needs. Each criteria is weighted to reflect its importance to my overall assessment.

Core Functionality (25% of Total Weighting Score): To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Budget tracking and forecasting

- Expense reporting

- Time tracking and billable hours management

- Invoice creation and management

- Financial reporting and analysis

Additional Standout Features (25% of Total Weighting Score): To help further narrow down the competition, I also look for unique features, such as:

- Innovative features that set a product apart from its competitors, such as real-time financial dashboards or AI-driven cost predictions.

- Tools that offer unique integrations with other financial software or advanced analytics capabilities.

- Features that contribute to a more comprehensive financial overview within the context of project management.

Usability (10% of Total Weighting Score): To get a sense of the usability of each system, I consider the following:

- The balance between powerful features and a user-friendly interface.

- Design elements that facilitate ease of use, such as intuitive navigation and clear visual hierarchies.

- Interactive elements like drag-and-drop scheduling tools or easy-to-use financial data entry interfaces.

Onboarding (10% of Total Weighting Score): To evaluate the onboarding experience for each platform, I consider the following:

- Availability of resources such as training videos, templates, and interactive product tours.

- Ease with which new users can migrate to the platform and begin realizing its value.

- Support mechanisms, like chatbots and webinars, that assist with the onboarding process.

Customer Support (10% of Total Weighting Score): To assess each software provider’s customer support services, I consider the following:

- Responsiveness and availability of customer support teams.

- Quality of support provided, including the depth of knowledge and problem-solving capabilities.

- Access to a variety of support channels, such as email, phone, and live chat.

Value For Money (10% of Total Weighting Score): To evaluate the value for money of each platform, I consider the following:

- Comparison of pricing structures against the features and benefits offered.

- Cost-effectiveness of the software, taking into account its ability to meet financial tracking and project management needs.

- Scalability and how the software's pricing accommodates growth.

Customer Reviews (10% of Total Weighting Score): To get a sense of overall customer satisfaction, I consider the following when reading customer reviews:

- Feedback from a broad range of users to gauge overall satisfaction.

- Recurring themes in reviews that may indicate strengths or weaknesses.

- The credibility and consistency of user testimonials.

Trends for Project Management Software with Financial Tracking in 2024

Project management software is constantly evolving to meet the needs of modern project managers. Here are some trends I’ve noticed for project management software technology as of 2024 and how they can impact PM software’s financial tracking capabilities in the future:

- Integration with Real-Time Analytics: Project management tools are increasingly integrating real-time analytics for financial tracking, which helps project teams gain immediate insights into project expenses and budget status.

- Enhanced Data Security Measures: Security protocols within project management software are being more fortified, especially for financial data. Encryption and multi-factor authentication are becoming standard. This trend is vital for protecting sensitive financial information from unauthorized access.

- AI-Powered Forecasting: Artificial intelligence is increasingly being used to analyze past project data to forecast budgets and expenses and predict financial outcomes in project management. This trend is particularly interesting for its potential to reduce financial risks and improve planning accuracy in the future.

- User-Friendly Financial Dashboards: Financial tracking is also being simplified through more intuitive dashboards that present complex financial data in an accessible manner. These dashboards can enable users with varying expertise to understand and manage project finances effectively.

- Mobile Accessibility: Finally, mobile access to financial tracking in project management software is on the rise, meaning that project managers and teams can monitor and update financials from anywhere using a mobile app. This trend is important for maintaining project continuity and real-time financial oversight.

What is Project Management Software with Financial Tracking?

Project management software with financial tracking is a type of software that combines traditional project management functions with financial management features. This integration allows users to manage their projects, including tasks, schedules, and resources, while also keeping track of project budgets, expenses, and overall financial performance. These features also give a clear view of a project’s financial status, enabling users to monitor spending, predict future costs, and make smart financial choices during the project.

Features of Project Management Software with Financial Tracking

Project management software with financial tracking is an important tool for maintaining control over project budgets and ensuring financial health. The right software can provide a comprehensive view of project finances, enabling project managers to make informed decisions. Here are some of the most important features to look for:

- Budget Management: This feature allows users to set up and monitor project budgets. It can be vital to ensuring that projects stay within financial constraints and to identify potential overruns early.

- Expense Tracking: With this feature, all project-related expenses can be recorded and categorized. This helps maintain transparency and accountability for where and how funds are spent.

- Time Tracking: This functionality enables users to log their time spent on project tasks using timesheets or other methods. This can be important for accurate billing and for assessing the profitability of projects.

- Billing and Invoicing: This feature streamlines the creation and sending of invoices based on project work, ensuring timely payment and maintaining cash flow.

- Financial Reporting: Comprehensive financial reports provide insights into the financial performance of projects. They are essential for strategic planning and reporting to stakeholders.

- Cost-to-Completion Tracking: This feature forecasts the remaining costs to complete a project. This is important for managing expectations and for making informed financial decisions.

- Profitability Analysis: Analyzing the profitability of projects can help users determine their financial success. This is key for evaluating a project’s return on investment and for future project selection.

- Resource Allocation: This functionality shows where and how resources are allocated financially. This is necessary to ensure that funds are used efficiently and effectively.

- Risk Management: Identifying and managing financial risks is instrumental to project success. This feature helps in mitigating potential financial issues that could impact the project.

- Integration with Accounting Software: The ability to integrate with existing accounting systems ensures consistency in financial data by eliminating the need for duplicate data entry, reducing errors and saving time.

Benefits of Project Management Software with Financial Tracking

Project management software with financial tracking capabilities offers a wide range of advantages that can significantly improve the efficiency and effectiveness of managing projects. Below are five primary benefits of implementing such software:

- Real-Time Budget Monitoring: By using project management software with financial tracking, users can monitor budgets in real time, allowing for immediate adjustments and decision-making to keep projects within financial constraints.

- Cost Reduction: The software helps in pinpointing unnecessary expenses, thus aiding organizations in reducing costs and allocating resources more efficiently.

- Enhanced Decision Making: With comprehensive financial data at their fingertips, users can make informed decisions that align with the project's financial health and strategic objectives.

- Improved Financial Reporting: The software streamlines the reporting process, making it easier for users to generate accurate financial reports and for stakeholders to understand the financial status of projects.

- Increased Accountability: Financial tracking features ensure that all transactions are recorded, promoting accountability among team members and clarity over who is responsible for various financial aspects of a project.

Overall, integrating financial tracking into project management software can help businesses to closely monitor their project finances, providing tools for strategic decisions and cost reduction. This simplifies financial management and results in more accountable and financially secure project management.

Costs & Pricing of Project Management Software with Financial Tracking

One of the most important aspects of selecting project management software with financial tracking involves considering various plans and pricing to fit your business size and needs. Options range from free versions for small teams or individuals to advanced enterprise-level plans that are packed with features. However, pricing plans for PM software also typically fall into common categories.

Understanding common plans and pricing is important to making an informed decision that aligns with your organizational needs and budget constraints. The last thing you want is to pay for features you won't use or accidentally overpay for common features.

Below is a table summarizing the plan types, average prices, and common features included in project management software with financial tracking:

Plan Comparison Table for Project Management Software with Financial Tracking

| Plan Type | Average Price | Common Features |

| Free Option | $0 (Free) | Basic task management, limited projects, simple scheduling, time tracking, file-sharing |

| Individual | $5 - $10 per user/month | Task management, basic scheduling, time tracking, standard Gantt charts, file-sharing |

| Small Business | $10 - $25 per user/month | Collaboration tools, project tracking, task management, product planning, expense and time tracking |

| Mid-Market | $25 - $60 per user/month | Advanced communication, collaboration tools, file and document-sharing, version control, reporting |

| Enterprise | Custom Pricing | Comprehensive project management features, multi-language support, multi-currency, advanced security |

When selecting a project management software plan, consider the size of your team, the complexity of your projects, and the specific features you need. Remember that free versions are great for getting started, while paid plans offer more advanced features for growing businesses.

Always look for options that provide the right balance between functionality and cost to ensure efficient project and financial management. It can be a delicate balance, but it is achievable.

Project Management Software with Financial Tracking FAQs

Here are some of the frequently asked questions I get asked about project management software with financial tracking.

How does financial tracking in project management software improve project delivery?

Financial tracking within project management software provides real-time visibility into the financial health of a project. It allows project managers to monitor budgets, forecast costs, and manage resources more effectively. This leads to better decision-making, which can result in projects being delivered on time and within budget.

Is project management software with financial tracking suitable for small businesses?

Yes, project management software with financial tracking can be highly beneficial for small businesses. It helps in managing projects more efficiently by providing insights into financial data, which is vital for maintaining tight budgets and ensuring profitability.

How secure is financial data in project management software?

Project management software typically includes comprehensive security measures to protect financial data. This includes encryption, access controls, and secure data storage. However, it’s essential to review the security features and compliance certifications of the software to ensure it meets your organization’s security standards.

Does using project management software with financial tracking require financial expertise?

While having financial expertise can be beneficial, it is not a requirement to use project management software with financial tracking. These tools are designed to be user-friendly and often include tutorials and support to help users understand and manage the financial aspects of their projects.

What kind of support can I expect from providers?

Support options can vary, but often include online resources, tutorials, customer service via phone or email, and sometimes dedicated account management, especially for higher-tier plans.

What Next?

Want to connect with other digital project managers to share resources and best practices? Join our membership community and get access to 100+ templates, samples, and examples, and connect with 100s of other digital project managers in Slack.