According to Future Data Stats, the project management software market is projected to become a USD 20.50 billion industry by 2030. Project management software is set to explode over the next decade.

In this article, I will sift through as much data as I can to help you make the best decision when it comes to investing resources in the project management software market.

Project Management Software Market Size

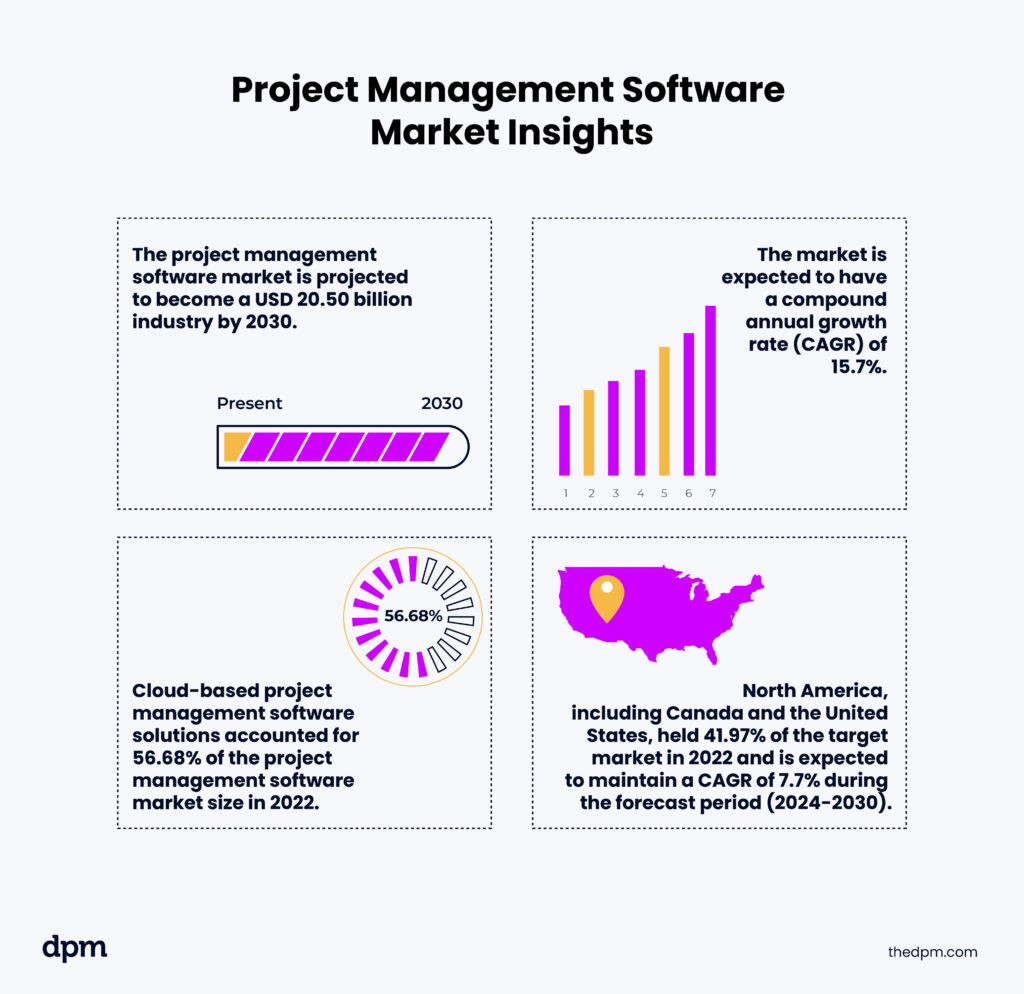

It is estimated that the project management software market size will increase to USD 20.50 billion by 2030 with a compound annual growth rate (CAGR) of 15.7%! This indicates a strong need for project management software.

The global project management software market is on a consistent growth track. Due to ever-increasing complexity of projects, resource allocation, general budgeting, and, of course, team communication, the project management software market shows no signs of slowing down.

In 2022 alone, IT & Telecom companies accounted for $1,566.7 million in revenue in the market. This is a sizable bite out of the USD 6.59 billion valuation for project management software in 2022.

The size of the market largely depends on whether or not you consider “services” or “solutions” to be included in the project management software market.

In this article, I am working with the assumption that both project management software services AND project management software solutions encompass the global project management software market.

Project Management Software Market Insights

I am going to analyze a variety of factors that drive the growth of the market and where we can see opportunities for the project management software industry.

Below, I will:

- Define what areas are driving growth for project management software

- Identify what is holding back an increasing demand for project management software

- Break down the project management software market in detail

- Analyze the current and future market trends for the project management software industry

- Forecast some areas of future growth in the project management software market size based on likely factors that will continue to drive growth for project management software

Project Management Software Market Drivers

I hinted earlier at a few reasons the project management software market is growing, but here is a bit more exhaustive list:

- Cloud-based solutions: The cloud-based solutions market is expanding at an exponential rate, projected to surpass on-premise solutions within the forecast period (2024-2030).

- Real-time project monitoring: There is an increased need for real-time task management and communication.

- Effective collaboration and communication: The increased need for project tracking and monitoring has led to an increased need for simplified and efficient collaboration.

- Streamlining project management processes: Managing projects in a timely and effective manner using effective business processes is only going to increase in complexity as projects become more complicated and more numerous.

- Increasing demand for workflow management: As project management grows, so will the teams working on projects. This will require more efficient workflow and team management.

- Increasing complexity of project management software: Part of the growth of the project management software market size is due to the need for more sophisticated software.

- Increasing awareness of project management systems: More and more businesses are becoming aware of the need for project management software, but also of the major players who are reaping the benefits of using project management software.

Project Management Software Market Restraints

When considering project management software market size, there aren’t as many restraints to the CAGR of the industry as one might think. Listed below are a few of the major restraints hindering the project management software market’s growth:

- Growing concern over data use and protection: People are becoming more concerned about data breaches, misuse of personal information, and generally sharing information and connecting online. This makes some hesitate to have so much of their business data shared in the cloud via project management software tools.

- High and increasing costs: The costs of project management software can be prohibitively expensive to smaller enterprises or businesses who are unable to scale effectively and afford the cost of project management software.

Analysis of Project Management Software Market Segments

As we look at the project management software market size, we must consider a variety of factors and how they will impact not only the current market but the future market as well.

Market trends such as agile project management aren’t going away. Flexibility and adaptability are becoming defining features of the industry.

With this in mind, I am going to analyze the project management software market size by: deployment, end-user industry, region, and enterprise size. By the end of this analysis, we will be able to see where the project management software market size sits in relation to both previous years, current standings, and where the growing demand is.

By Deployment

When it comes to deployment, the project management software market is divided up into on-premise and cloud-based solutions, with cloud-based solutions taking up the largest market share, according to a Straits Research market report.

Grand View Research claims cloud-based project management software solutions accounted for 56.68% of the project management software market size in 2022.

Businesses are trending toward using cloud-based solutions rather than on-premise solutions. However, Grand View Research also states a CAGR of 14.4% for on-premise solutions during the forecast period (2024-2030).

By End User Industry

SkyQuest Technology reports that industries like the Oil & Gas, IT & Telecom, Healthcare, and Government are some of the key players when it comes to market share for project management software.

Other end-user industries that make up the project management software market include:

- BFSI (Banking, Financial Services, and Insurance)

- Engineering and Construction

- Retail

- Manufacturing

While not all the company profiles within these industries are taking advantage of project management software, many of these market players are undergoing a digital transformation that is leading to market expansion today.

By Region

Dividing the project management software market size up by region can be difficult because so many regions are now involving themselves in the project management software market.

However, key players for this market include:

- Asia Pacific: Countries like India, China, Japan, South Korea, Australia, and other Asia Pacific countries are predicted to hit a CAGR of ~13%.

- North America: North America, including Canada and the United States, held 41.97% of the target market in 2022 and is expected to maintain a CAGR of 7.7% during the forecast period (2024-2030).

- Europe: Major countries include France, Germany, Italy, Spain, and Russia, but don’t discount the rest of Europe.

- Latin America: Key players include Brazil and Mexico.

- Middle East & Africa: Primary market leaders are South Africa, Saudi Arabia, and the UAE (United Arab Emirates).

The United States of America sets itself apart as the project management software market leader, but countries in Asia Pacific are predicted to have massive revenue shifts during the forecast period (2024-2030) with India, for example, predicted to represent a CAGR of 13.1%.

By Enterprise Size

As mentioned earlier when discussing restraints in the market overview, the high cost of these software solutions makes SMEs’ (small and medium enterprises) share of the market smaller than expected.

According to Persistence Market Research, the largest market is the large enterprises segment, which has the highest revenue share in the global project management software market. This segment is expected to hit a market value of USD 12.2 billion within the forecast period (by 2030).

Project Management Software Competitive Landscape

With a market ripe with growing demand, there is a good amount of competition in the project management software space.

Many of these software solutions offer free trials of their products, so feel free to explore each in-depth. Here is a brief breakdown of some of these powerful solutions, as well as a few other software systems:

- Monday.com: one of the best project management software systems for those interested in automating as much as possible at a cost-effective entry price

- Zoho Projects: flawless integration with other Zoho projects, making it great for partnerships with other Zoho products

- Jira: an Australian-American owned Atlassian corporation PLC (project life cycle) software known for project management across multiple teams and individuals, focusing on project tracking across teams

- SAP SE Project System: SAP SE’s project management system built by the company leading in market share in the project management software industry focused on portfolio management

- Clarity: a digital project management software solution from Broadcom Inc. centered around analyzing and utilizing market dynamics for the success of smooth and efficient business processes

- Wrike: a project management tool focused on workflows, specifically on streamlining the approval process and file proofing in various project flows

- ServiceNow: a project management software solution focused on project portfolio management

Recent Developments in the Project Management Software Market

The project management software market, being in a time of growth and never-ending advancements, is constantly changing. This means the news cycle for this market, and the accompanying market trends, are ever-evolving.

Here are some newsworthy market trends and market news for the project management software industry:

- In March 2024, a top-tier cloud-based platform, LambdaTest, and Inflectra, a global leader in IT Software Lifecycle Management, announced their strategic partnership. This partnership sets the stage to change how teams manage and deliver software projects.

- March 2024: The Microsoft Corporation doubles down on Copilot software being used for project management with their Dynamics 365 Project Operations tool.

- In December 2023, Infibeam Avenues announced they were becoming 49% stakeholders in Pirimid Fintech, a company with capital market trading software, to combine market trading and AI ventures for financial services project management.

- In 2022, there were several developments that began paving the way for the future of the project management software market, including mergers of ServiceNow and Era Software as well as a shift to begin focusing on file storage and collaboration.

- Oracle Corporation launched their workflow manager, staking a claim on the workflow management software space, in 2022.

Key Trends In The Project Management Software Market

Based on current research reports for 2024, the project management software market is set to expand and deepen their advancements into the forecast period (2024-2030).

As we look ahead to the future of digital project management software, we should consider the impact of AI and machine learning tools and their effect on the project management software market size.

Another consideration is resource management. Business processes are becoming more complex, and services and solutions rendered by companies are becoming intricate and flexible to each client’s needs. This will require a new approach to resource management for project management software.

Lastly, end-users should pay close attention to the market as cloud-based solutions begin to become more secure and, therefore, more easily accessible to SMEs and large enterprises alike.

This market trend is not going anywhere and cloud-based solutions are going to become more prominent in every industry as security technology improves.

Stay On Top of Project Management Software Trends

If all of this data has your head swimming, sign up for DPM membership to gain access to our Slack community and a goldmine of a hivemind of digital project managers like yourself. You’ll also get access to 100+ templates, samples, and examples.